Part II of the series on the impact of tax reform on cooperatives discusses the changes to Unrelated Business Income Tax (“UBIT”). Whereas Part I primarily focused on taxable cooperatives and new Section 199A, this part focuses on tax-exempt cooperatives (especially Section 501(c)(12)).

On December 22, 2017, Congress’ new tax reform bill became law as Public Law 115-97 (the “Act”). The Act substantially amends the Internal Revenue Code including provisions that directly impact cooperatives.

UBIT Existing Law: Netting Permitted

The income of tax-exempt cooperatives and other tax-exempt organizations is generally not subject to tax. But Section 511 of the Code imposes a tax on their “unrelated business taxable income” (“UBTI”). Subject to numerous exceptions, UBTI is gross income from an unrelated trade or business regularly carried on by the organization, less deductions directly connected to the unrelated trade or business. A deduction of $1,000 is applied unless it creates an unrelated business net operating loss (“UBNOL”).

UBIT New Rule: Netting Not Permitted

Under prior law, UBTI and UBNOLs from multiple trades or businesses were aggregated and netted. The Act revises this calculation by requiring tax-exempt organizations to separately compute UBTI for each separate trade or business. The new rule precludes the netting of UBTI and UBNOLs among different trades or business. Thus, under the new rule, UBNOLs only may be used to offset income from the same trade or business.

However, the new rule does not apply to UBNOLs created in tax years beginning before January 1, 2018. They may continue to be carried forward to offset UBTI, even if the UBNOL is from a trade or business.

Section 501(c)(12) UBTI Reminders:

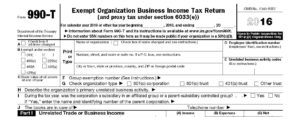

- UBTI and UBIT are reported on IRS Form 990-T.

- UBTI does not include any income that qualifies as income from a “load loss transaction” under Section 501(c)(12)(H).

- Pole rental is not considered an unrelated trade or business.

Stay tuned for more information about the tax reform law and its impact on cooperatives. See the prior post in this series about new Section 199A. See other posts about cooperative taxation.